Investing in the Future.

Investing Creatively.

We are a dynamic investment firm focused on leveraging innovative strategies to unlock the potential of both traditional and digital asset markets. Our approach blends provocative creativity with calculated financial strategies, allowing us to redefine capital investment and transform it into a diverse array of profitable business opportunities.

Founded on the principle of creative investment, we seek to reshape industries and unlock value in untapped sectors. We meticulously design our investment portfolio, spanning a wide range of industries from tangible commodities and real estate to the latest in digital tokenization platforms. By co-establishing forward-thinking ventures such as “Ordinary Ground”, a real estate development company, and investing in “Flips Innovative”, a tokenized platform for capital-raising, we push the boundaries of conventional investment to create endless possibilities for growth.

Our Vision

At Venture Common, our philosophy is to invest in the future with a dual focus on delivering financial returns and developing sustainable societal impacts. We believe in continuously reinvesting profits into innovative ventures that create lasting value for both our stakeholders and the communities in which we operate. Our vision is to transform ordinary products and projects into profitable opportunities by integrating creative strategies with in-depth market analysis. Through our commitment to direct investments, we push the boundaries of possibility, advancing traditional industries with extraordinary results while carefully managing risk to ensure consistent, high returns.

Our Mission

Venture Common is dedicated to identifying untapped potential in ordinary products and markets, with a mission to restructure and rejuvenate businesses for optimal returns. By strategically driving profitability, the company ensures that its investments not only fuel economic growth but also contribute to positive social impact. Through these efforts, Venture Common creates a balance between financial success and broader societal benefits, fostering long-term value creation across its portfolio.

We are committed to identifying untapped potential in ordinary markets, restructuring businesses for optimal returns while promoting economic growth and positive social impact.

Key Investments 2024

Venture Common co-founded Ordinary Ground, a real estate firm that integrates innovative architecture with sustainability, prioritizing residents’ needs while promoting social responsibility and environmental well-being.

An innovative hospitality project offering cryptocurrency-based ownership and exclusive privileges, designed by award-winning architect Duangrit Bunnag, seamlessly combining luxury, modern design, and premium benefits for token holders.

Venture Common invested in Flips Innovative, a blockchain-based digital asset platform for real estate capital raising, enhancing liquidity and security through tokenized assets for retail investors.

Sustainability and Social Impact

At Venture Common, we believe in investing in possibilities that contribute not only to financial growth but also to the betterment of society. Whether through innovative real estate projects or the adoption of digital asset platforms, our focus remains on creating value that benefits communities and preserves the environment. Projects like Ordinary Ground and the Flips Innovative Platform embody this commitment, blending economic returns with social responsibility.

Global Partnerships

Our extensive network of partners spans Thailand, Europe, USA, Republic of Korea and Singapore. We collaborate with top financial institutions, including Top Prime European Banks in Germany, Switzerland, UK, USA and Top Local Banks in Thailand, Republic of Korea and Singapore, ensuring strong financial backing for our ventures. These strategic partnerships allow Venture Common to maintain a fluid fund movement across continents, making us a key player in global investment and trading markets.

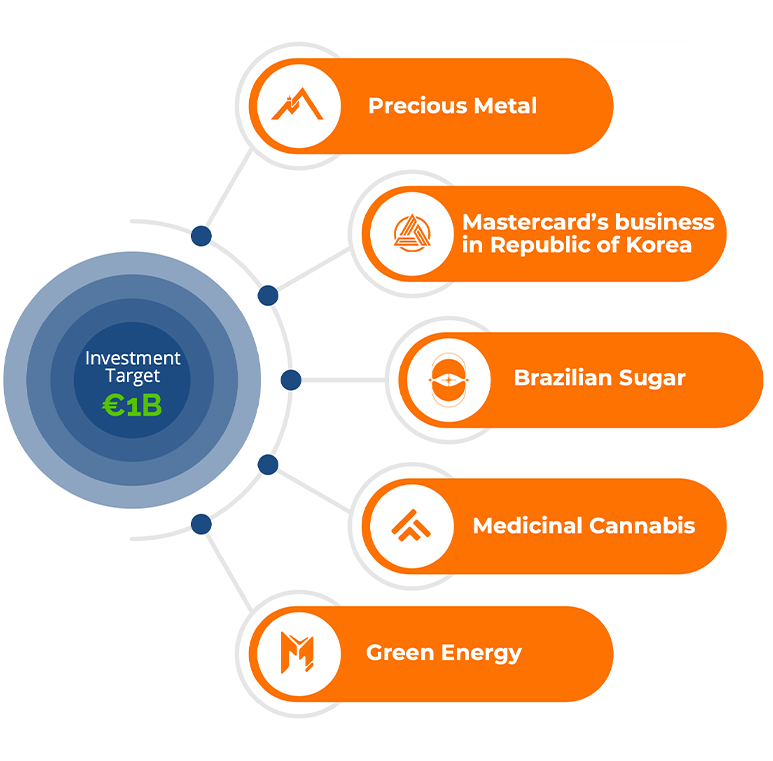

Global Strategic Investment Vision

At Venture Common, our commitment lies in identifying and supporting market-defining companies from their inception, encouraging long-term growth across global markets. By prioritizing strategic investments in cutting-edge technologies and emerging digital infrastructure, we aim to transform traditional sectors and build innovative industries. Our approach aligns with that of industry leaders, emphasizing visionary entrepreneurship and sustainable growth. With a forward-looking strategy, we focus on both local and international opportunities, enabling us to foster value across diverse industries, including real estate, digital assets, and tokenized platforms, thereby driving economic and technological advancement on a global scale.

Innovation and Vision for the Future

Our approach to investment is rooted in identifying high-growth companies across various sectors. We prioritize data-driven strategies that capitalize on the rapid advancements in technology, such as blockchain and digital transformation. By strategically investing in these disruptive sectors, we aim to create new avenues for profitability and ensure our portfolio remains at the forefront of global trends. Our focus on emerging industries allows us to transform traditionally stable markets into high-value, technologically advanced sectors.

Long-term Commitment to Transformation

At Venture Common, we take a hands-on approach to nurturing businesses throughout their journey. We offer more than just capital; we provide strategic guidance to ensure long-term success and market dominance. This philosophy is grounded in a deep understanding of global economic shifts, allowing us to drive transformation in businesses and industries. Our commitment to building lasting companies ensures that we remain a key player in reshaping industries, from the initial stages to their eventual market leadership.

Venture Common

We are driven by innovation, strategic investments, and a commitment to reimagine business opportunities for a better future. Our integrated approach to blending traditional commodities, real estate, and digital assets positions us as a leader in exploring new possibilities within a chaotic market. By nurturing investments in forward-thinking businesses, we continually cultivate layers of profitability while contributing to social and environmental causes.

Our Investor Services Team is dedicated to assisting you with any inquiries related to Venture Common investments. Whether you have general questions, need assistance with valuations, or require access to our telephone dealing facility, we are here to ensure a seamless experience.

For personalized support or additional information, please feel free to contact us:

Thailand Head Office

Venture Common Co., Ltd.

760/1 Lad Ya Road, Khlong San, Bangkok 10600 Thailand

We look forward to supporting you on your investment journey with Venture Common.

FUNDS & INVESTMENT

FUNDS & INVESTMENT Venture Common

Venture Common